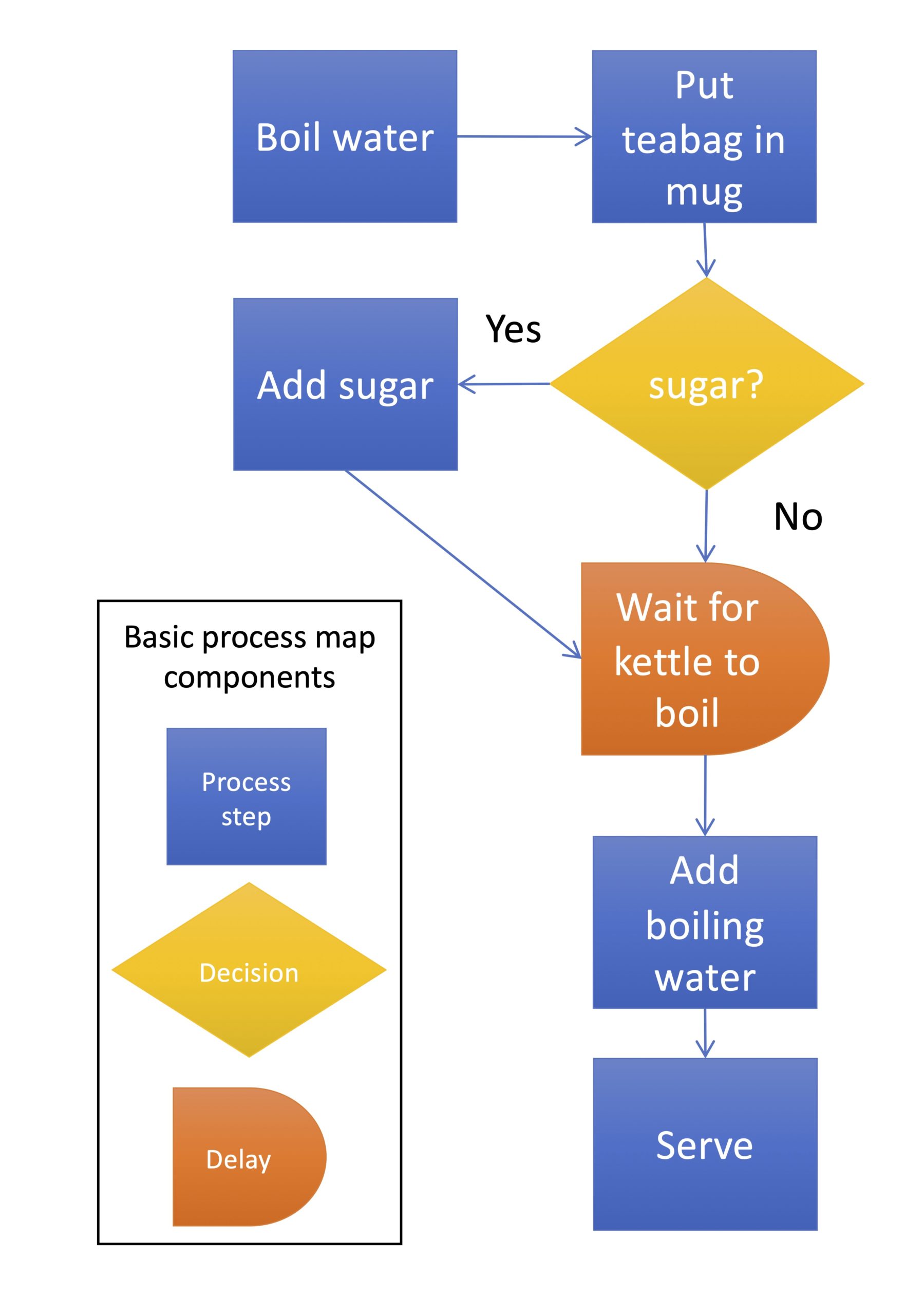

Getting Started Fast: Business Process Management for Bank Operations Documenting error root causes and removing needless variation from these processes can help standardize the work and mitigate possible risk. Human error in processes such as know your customer (KYC) and credit review cause more than re-work – they can expose the bank to regulatory and financial risk. Flow charts, if created properly, will also capture the keystroke-level detail required to automate the work at scale. A few examples:ĭocumenting customer touch points during processes such as account opening, loan origination and fraud reporting can help the bank improve customer experience based on specific data and anecdotes.ĭetailed flow chart documentation for high volume transactional processes such as loan application data entry, billing and wire processing can help identify specific steps that can benefit from automation.

Regardless of size or region, detailed process flows can be used to the bank’s advantage in a variety of ways. Certain large commercial banks (e.g., Citi, Wells Fargo, etc.) even have centers of excellence devoted entirely to process automation and cost reduction. Mid-size and large banks typically have internal teams that are responsible for analyzing business processes to improve productivity and customer service. How do Banks Use Process Modeling and Workflows to Improve Operations? Contact us now to discuss a BI engagement with OpsDog. Let us take your KPIs & business intelligence efforts to the top.

0 kommentar(er)

0 kommentar(er)